It’s Just a Part of the Journey:

Debt is something that everyone encounters on their financial journey. And if debt is something that you’re struggling with, don’t worry. You’ve come to the right place. Our guides are here to help you understand and manage this obstacle, reminding you that financial wellness can be a part of everyone’s journey.

It’s important for you to understand how you can manage your debt and maintain strong credit. When you come into debt, it can become an obstacle on your journey that you have to overcome as opposed to a tool to help you achieve your goals. However, with the proper management and leveraging, this doesn’t have to be your experience.

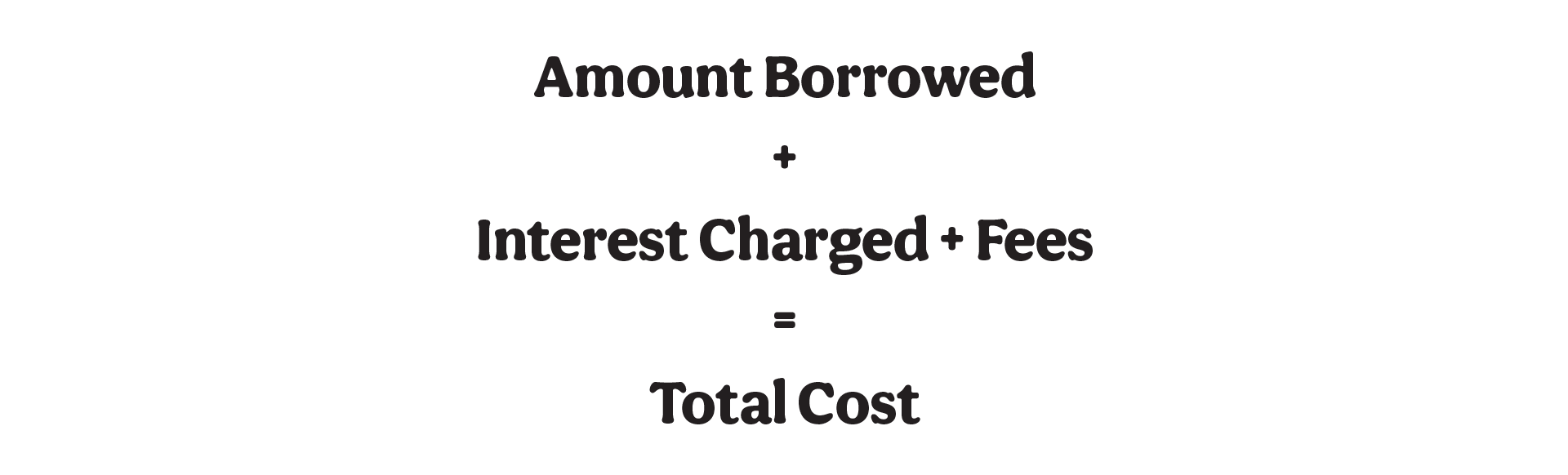

Before borrowing any money, make sure that you understand and calculate the total cost of repaying that debt. Here’s how:

With this information, you can create a plan to pay off this debt. Why is this important? Well, the amount of debt you have and the way in which you manage it is one of the largest factors that go into your credit score, that of which is extremely important to your financial health. This score is a number that determines how likely you are to repay your debts.

Want to keep hiking?

Financial Beginnings is a national 501(c)(3) nonprofit that empowers youth and adults to take control of their financial futures. Their educational programs incorporate all aspects of personal finance to give individuals the foundation they need to make informed financial decisions. Financial Beginnings reaches more than 200 K-12 schools and colleges and more than 100 community-based organizations annually, serving all groups with special focus on populations most in need. For more information, visit www.financialbeginnings.org.